Section 194N-TDS on Cash Withdrawal after Press release dated 13.05.2020

June 25, 2020

Section 194N – TDS on cash withdrawal

Important Points:

1. The budget 2020 has reduced the threshold limit for TDS to Rs 20 lakh for taxpayers who have not filed their income tax returns for past three years. Such taxpayers withdrawing cash in excess of Rs 20 lakh have to pay 2% as TDS.

2. Earlier, the Union Budget 2019 has introduced Section 194N for deduction of tax at source (TDS) on cash withdrawals exceeding Rs 1 crore to discourage cash payments.

3. Effective date of Amendment: Amendment of Section 194N will be with effect from 01 July 2020.

4. As per the press release dated 13.05.2020 issued with respect to “Reduction of TDS rates by 25%” in that list 194N is not covered so the same TDS rates of 2% or 5% will be applicable.

1. What is Section 194N?

Section 194N is applicable in case of cash withdrawals of more than Rs 1 crore/20 Lakhs during a financial year. This section will apply to all the sum of money or an aggregate of sums withdrawn from a particular payer in a financial year.

Withdrawal Made by:

1. An Individual

2. A Hindu Undivided Family (HUF)

3. A Company

4. A partnership firm or an LLP

5. A local authority

6. An Association of Person (AOPs) or Body of Individuals (BOIs)

Payers:

1. Any bank (private or public sector)

2. A co-operative bank

3. A post office

The tax will be deducted by the payer while making payment to any individual in cash from a taxpayer’s bank account on the amount in excess of Rs 1 crore/20 Lakhs as per the applicable case.

The limit of Rs 1 crore in a financial year is with respect to per bank or post office account and not a taxpayer’s individual account.

Example, a person having three bank accounts with three different banks, he can withdraw cash of Rs 1 crore * 3 = Rs 3 crores without any TDS.

The cash withdrawal made by any taxpayer from the bank accounts maintained by such recipient will only attract TDS under Section 194N. For instance, if a bank makes a cash payment of more than Rs 1 crore in an FY to its account holder (i.e any taxpayer) from the account maintained by such taxpayer, then the bank will have to deduct TDS.

In the case of a payment made by a taxpayer through a bearer cheque issued to third party, in excess of Rs 1 crore in a financial year, the recipient of the cash is not the account holder, but a third party. In such a case, the payment is not made by the bank to the account holder.

Separately, in case of business payments, payment made through a bearer cheque would not be allowed as an expenditure under section 40(A)(3) of the income tax act. Any payment made exceeding Rs 10,000 per day (in a single transaction or in aggregate) is not allowed as business expenditure.

The limit of Rs 1 crore will be applicable to the cash payments/withdrawals made during the FY 2019-20. The provisions of Section 194N will be applied to the payments made on or after 1 September 2019.

2. Why is Section 194N introduced?

The government has introduced Section 194N in the Union Budget 2019 proposed on 5 July 2019. In order to discourage cash transactions in the country and promote the digital economy, ‘Section 194N – TDS on cash withdrawals over and above Rs 1 crore’ has been introduced through the Finance Bill, 2019.

3. Who will deduct TDS under Section 194N?

The person (payer) making the cash payment will have to deduct TDS under Section 194N. Here is the list of such persons:

a. Any bank (private or public sector)

b. A co-operative bank

c. A post office

This Section is not applicable to the withdrawals done by:

a. Any government body

b. Any bank including co-operative banks

c. Any business correspondent of a banking company (including co-operative banks)

d. Any white label ATM operator of any bank (including co-operative banks)

e. Any other person notified by the government

4. What is the point of TDS under Section 194N?

a) TDS will be deducted by the payer while making the cash payment over and above Rs 1 crore in a financial year to the payee.

b) If the payee withdraws a sum of money on regular intervals, the payer will have to deduct TDS from the amount, once the total sum withdrawn exceeds Rs 1 crore in a financial year.

c) Further, the TDS will be done on the amount exceeding Rs 1 crore. For example, if a person withdraws Rs 99 lakh in the aggregate in the financial year and in the next withdrawal, an amount of Rs 1,50,000 is withdrawn, the TDS liability is only on the excess amount of Rs 50,000.

5. Rate of TDS under Section 194N:

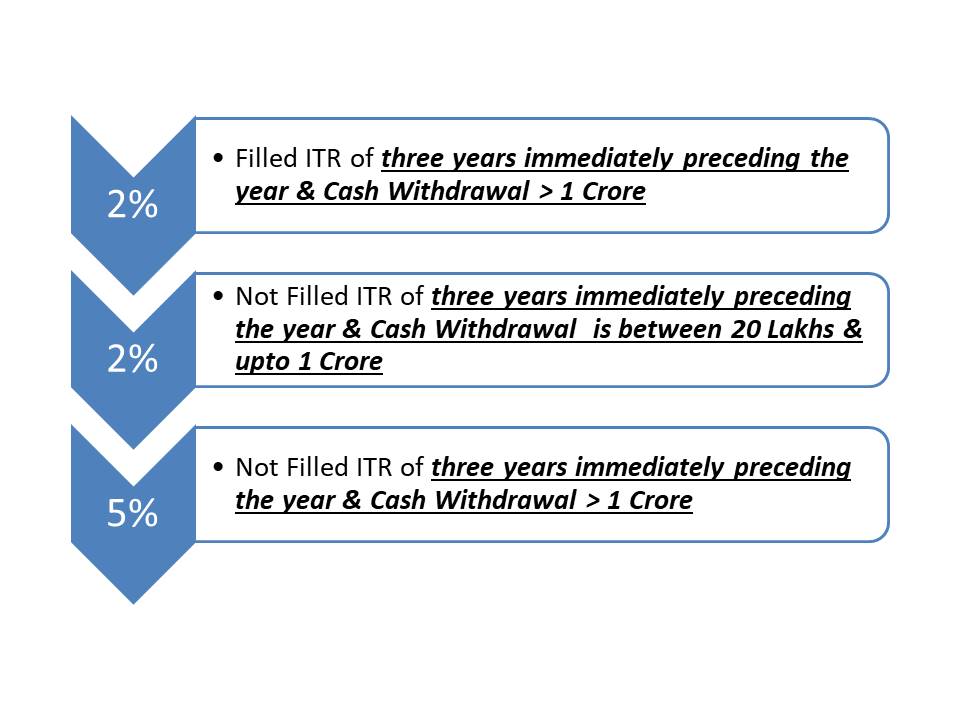

There are 3 categories under which the TDS will be deducted either at 2% or at 5%

The payer will have to deduct TDS at the rate of 2% on the cash payments/withdrawals of more than Rs 1 crore in a financial year under Section 194N. Thus, in the above example, TDS would be on Rs 50,000 at 2% i.e. Rs 1,000.

In case the individual, receiving the money has not filed income tax return for three years immediately preceding the year, then the TDS is 2% on the cash payments/withdrawals of more than Rs 20 lakh and up to Rs 1 crore, and 5% for withdrawal exceeding Rs 1 crore.

Points to be noted:

1. The Limit is Bank wise and not Branch Wise

2. The Limit will be aggregate of all accounts- Saving, Current, Cash Credit & OD

3. TDS will be on the amount exceeding the limit of 1 Cr/20 Lakhs and not on entire amount.

4. Purpose of cash withdrawal is irrelevant

5. It is not clear what will happen to those who are not required to file the return of income due to income below the basic exemption limit.

6. Over to all, it is not clear how the banks will ensure compliance with this requirement. If the bank starts taking a copy of ITR acknowledgement every time, it will, no doubt, only add to woes of the banks’ personnel.

7. The filing of return of income criteria and TDS on cash withdrawals will also pose problems where the business is not in existence for three years. How the bank will ensure this fact?

8. What will happen when the due date to file the ITR is extended? How the banks will act on the same?

– Compiled by CA Pavan Sharma,

(ACA, CS, DISA, B.com)

+91 9422414823 | contact@vdaassociates.com

You may also want to read: